10 Sep Weekly Forex Forecast (September 11 – 15, 2017)

Weekly Forex Forecast (September 11 – 15, 2017)

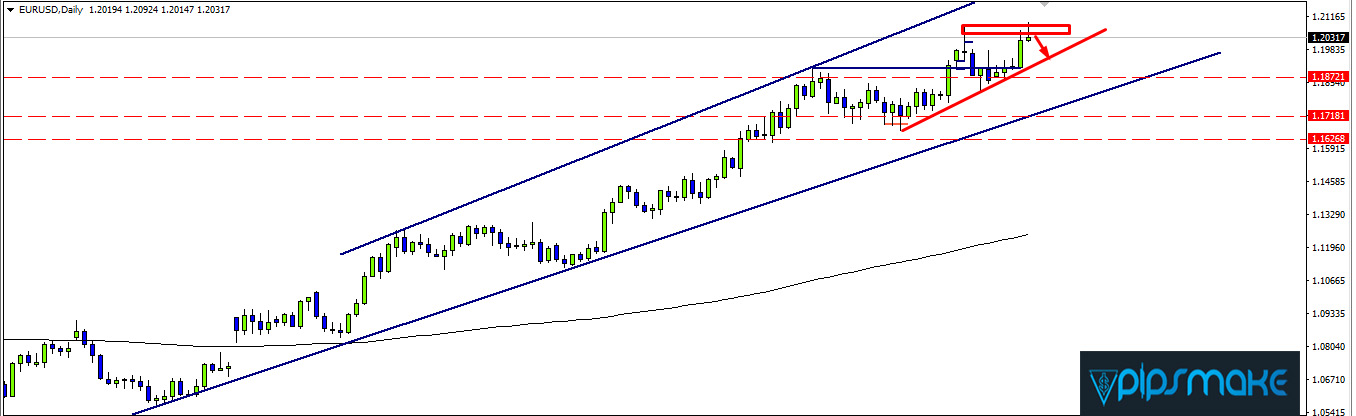

EURUSD bulls retested the 2012 low at 1.2040 last week after retreating from the area in late August. The result of the previous week’s rally was similar to that of August 29th with prices falling back below the 1.2040 handle before the session close.

This leaves the level intact as resistance for the new week. Key support is also unchanged at 1.1875. Depending on if and when sellers retest this area, it could become a confluence of support given the ascending channel from the April low.

Given Friday’s bearish pin bar from 1.2040, we may see the single currency lose some ground early this week. However, the candlestick is relatively small compared to Thursday’s range, which casts some doubt over Friday’s bearish signal.

A better signal that sellers have reclaimed control would be a daily close (5 pm EST) below channel support near 1.1875. Until that time, buyers remain in the driver’s seat, and the nearest support level will continue to limit losses.

GBPUSD: For Daily Green pips Click Here

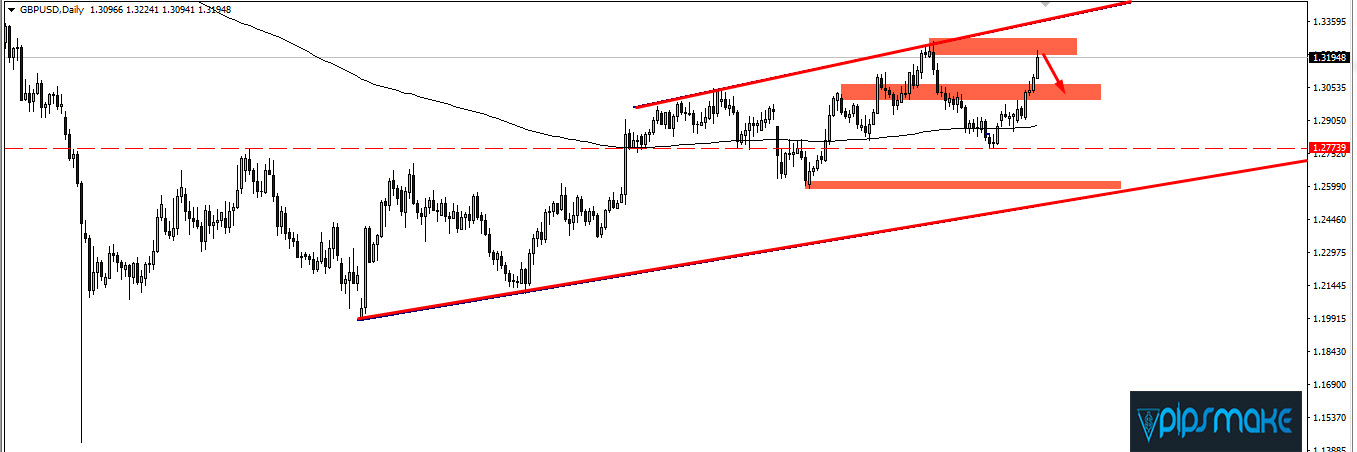

The GBPUSD took out a confluence of resistance last week at 1.2970. This area had capped the pair since the August 29th retest.

Apart from Monday’s session, buyers were in control every day last week. They even finished with a close above the 1.3125 handle, an area that has been a factor since June of last year.

That means any retest of the 1.3125 handle this week will likely encounter an influx of buying pressure. Key resistance for the week ahead comes in near the August high at 1.3250.

There is a major trend line that extends from the 2014 high that could also come into play over the next few weeks. At the moment that level is near 1.3350, but it all depends on if and when the GBPUSD bulls decide to extend last week’s rally.

USDJPY: For Daily Green pips Click Here

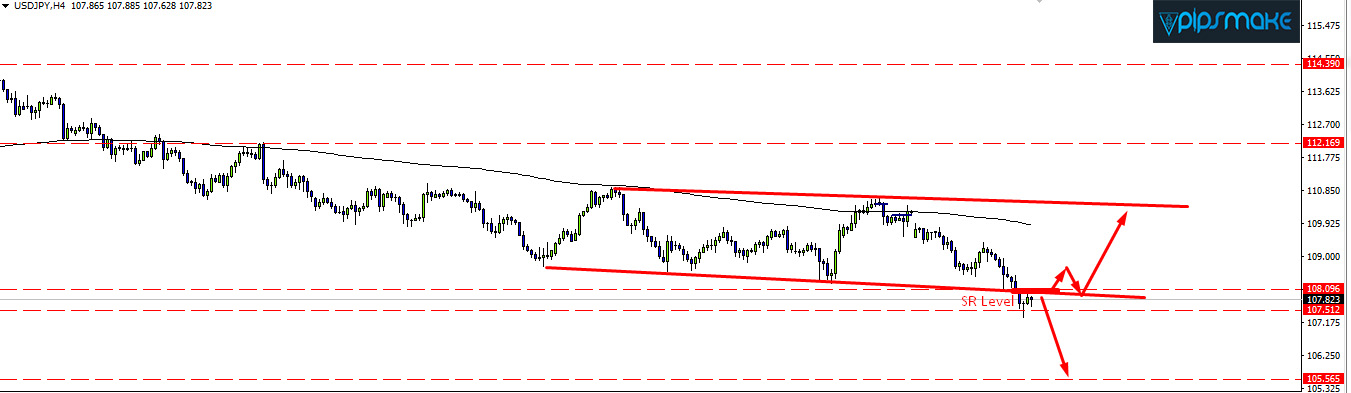

USDJPY bulls lost their grip on a significant level on Friday. The 108.25 area has been range support since mid-April.

With Friday’s close of 107.82, sellers are likely to stand their ground should the pair retest the 108.25 handle this week. A rotation into the area does seem probable given the distance between last week’s close and the 10 and 20 EMAs.

To the downside, there is a massive area of support at 106.00. This is the intersection of a key horizontal level and the trend line that extends from the September 2012 low.

A view of the weekly chart shows how the pair retested this level on four separate occasions between June and November of last year.

Bearish price action from the 108.25 area could produce a favorable opportunity to get short for a move toward 106.00. Alternatively, a daily close back above 108.25 would negate the bearish outlook.

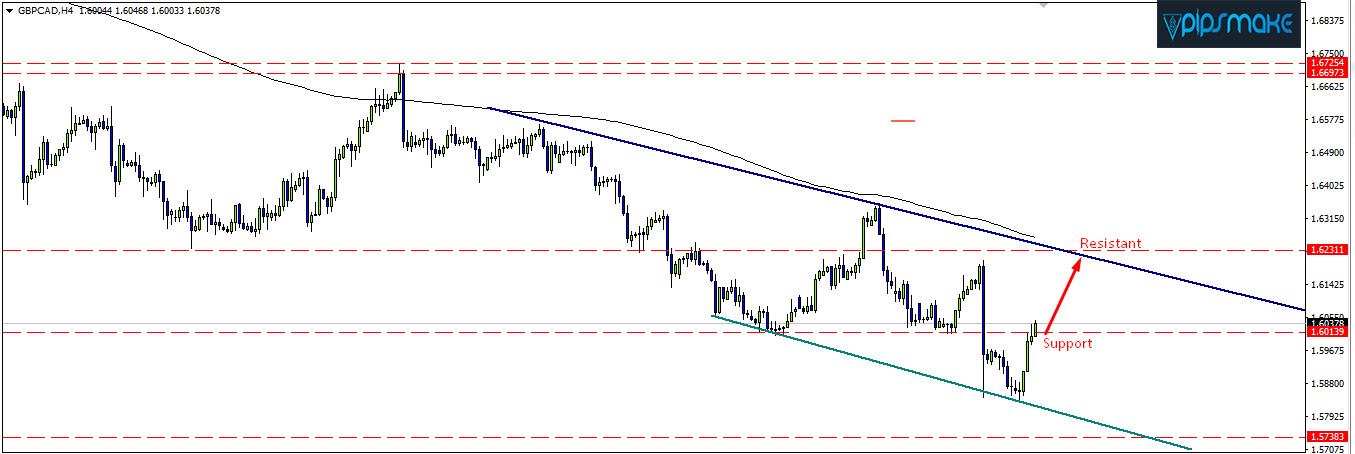

GBPCAD: For Daily Green pips Click Here

AUDCAD: For Daily Green pips Click Here

We start our Paid Trading signal service.

If you want this Signal then you can join with our paid Service.

90% profitable trading system.

If you interested about it click here