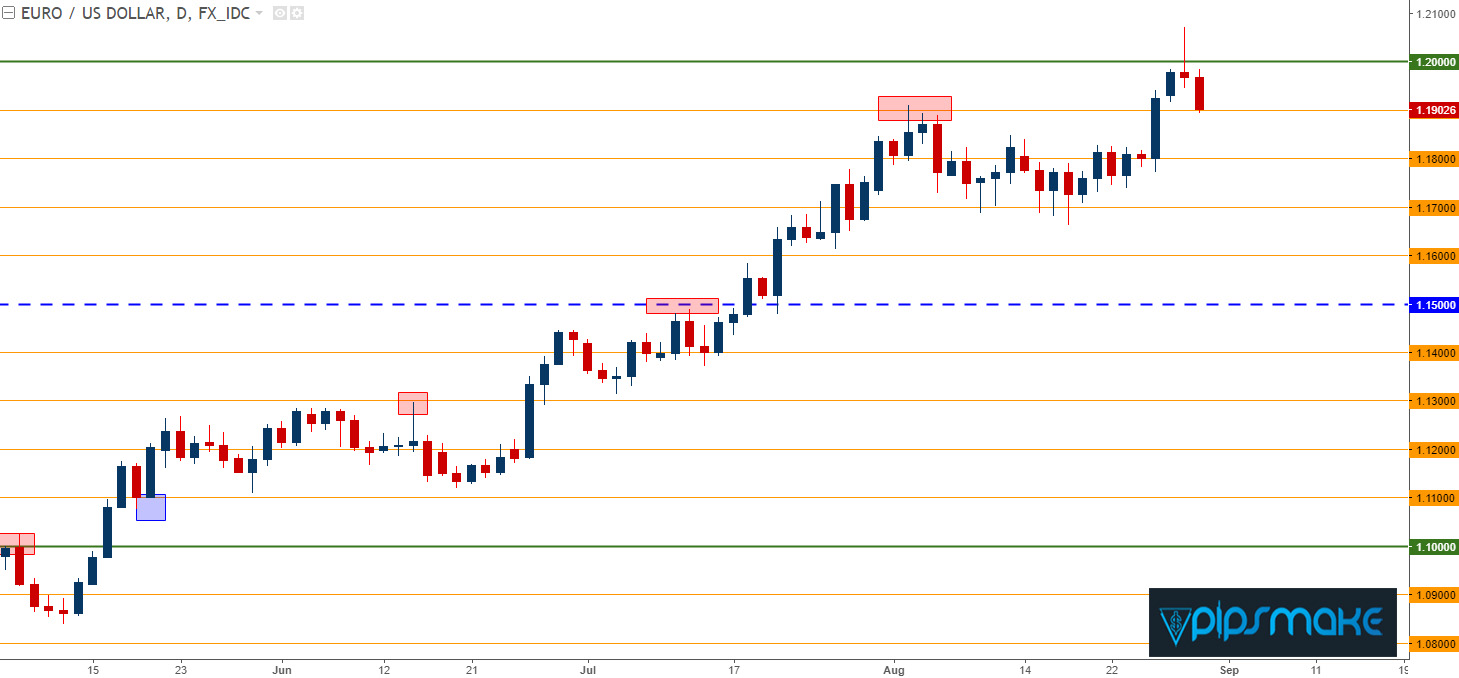

30 Aug EUR/USD is under pressure as Dollar strength continues off of yesterday’s lows.

A pivotal ECB meeting on the calendar for next Thursday, combined with prices moving above the psychological level of 1.2000 is likely creating some unwind of the prior bullish trend. For scenarios of extended USD-weakness, GBP/USD may be a more attractive option, as we discuss below.

– IG Client Sentiment remains elevated in EUR/USD, with a current read of -2.45 while GBP/USD is currently showing -1.1727.

– Want to see how Euro, GBP and USD have held up to the DailyFX Q3 Forecasts? Click here for full access.

In yesterday’s article, we looked at the U.S. Dollar after a fresh 2.5 year low had printed in ‘DXY’. We had also looked at the setup in USD/JPY as a long-term support zone continued to face tests in the region that runs from 108.13-108.83; but by the time our webinar was ready to go at 1PM Eastern Time, a reversal had already started to show in the Greenback. This opened the door for a litany of reversal setups in major pairs, including EUR/USD as an elongated wick extended beyond the 1.2000 psychological level. Since then, we’ve seen that theme continue to run as the Dollar is continuing to rally off of yesterday’s low.

This is far from confirmed yet as a theme yet, as we’re talking about almost eight full months of weakness running into one day of strength; but as we walk into a critical September for a number of Central Banks, and with a pivotal ECB meeting just one week away – the fundamental backdrop could certainly support the scenario of a pullback in the well-heeled trends of EUR/USD and, bigger-picture, USD-weakness as we move closer to encountering some of those drivers.

This reversal of strength in the U.S. Dollar has pushed EUR/USD lower from the pair’s 2.5 year highs above the 1.2000 handle. Earlier in the month, we discussed the importance of psychological levels like 1.2000, and with a key ECB meeting on the schedule for a week from now where investors are expecting to finally hear what the bank’s next steps with QE will be, it makes sense that we’d see some pullback or tightening of that prior theme of EUR/USD strength.

The daily chart of EUR/USD shows that elongated wick extended beyond 1.2000, with what has been some attractive follow-thru so far on the day. If today’s daily candle closes below 1.1950, we’d have an evening star reversal pattern, which could make the prospect of bearish setups that much more attractive as we walk into next week’s ECB meeting.

We start our Paid Trading signal service.

If you want this Signal then you can join with our paid Service.

80% profitable trading system.

If you interested about it click here